new york salt tax workaround

9 2022 945 AM. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services.

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

. On April 6 2021 New York Gov. The election is meant as a workaround to the 10000 cap. This consequential tax legislation available to electing pass-through entities provides a.

New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through Senate Bill 2509Assembly Bill 3009C including personal and corporate income tax rate increases an optional pass-through entity tax workaround and numerous other provisions.

New York is one of many states to enact this regime. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. 875 percent beginning July 1 2023.

In most states the owner. Connecticuts pass-through entity PTE tax for the SALT cap workaround is mandatory which is unique. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

When they put the limitation on SALT state and local tax because of their itemized deduction it kept. SALT Cap Workaround Enacted. 8 2022 145 AM.

July 1 2021 By WFFA. New York State 20212022 Budget Act SALT Cap Workaround The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

In part one of a two-part series Baker Botts William Gorrod Renn Neilson. New York State Lawmakers Finally Agree to SALT Workaround. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

On April 6 2021 New York Gov. The rate will be further reduced to 4. Pass-Through Entity Tax Update Part I.

Each partner receives a credit under New York tax law of 68500 and this amount is included in each partners New York adjusted gross income. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through. SALT Cap Workaround.

The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. Notice 2020-75 issued by the Internal Revenue Service in November 2020 appears to endorse these workarounds. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through Senate Bill 2509Assembly Bill 3009C including personal and corporate income tax rate increases an optional pass-through entity tax workaround and numerous other provisions.

The SALT cap limits a persons deduction to 10000 for tax years beginning after. Gross Receipts Tax Rate Reduced. The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act.

In the second of a two-part series Baker Botts William Gorrod Renn Neilson Matthew Larsen Jon Feldhammer and Ali Foyt share considerations for deciding whether to make the PTET election in a given state give an update on federal proposals to increase or eliminate the. 1 day agoIt started because of the Tax Cut and Jobs Act Kim Wright a partner with BST Co. New York Governor proposes pass-through entity tax as a workaround to the 10000 SALT deduction limitation - Mazars - United States.

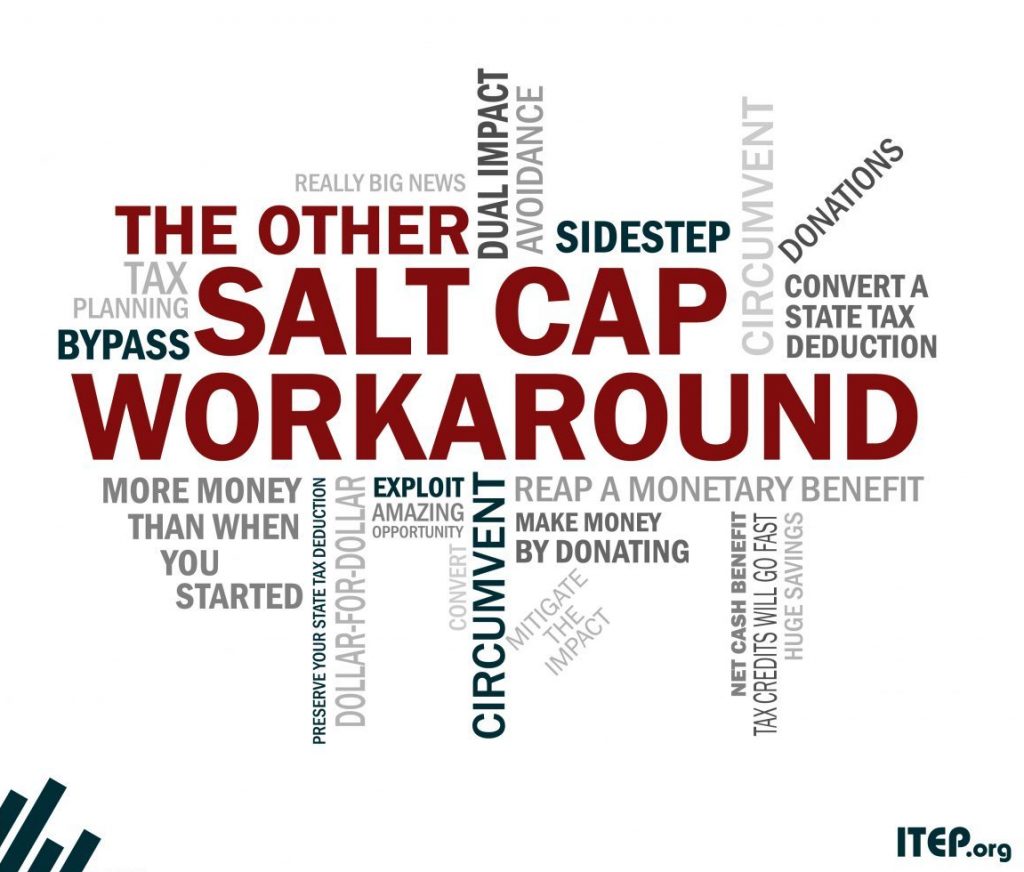

SALT Cap Workaround. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation. Governor Andrew Cuomos recent budget proposal submitted to the State Legislature includes.

The assembly and senate have passed the budget legislation and the legislation has been delivered to the governor for signature. The PTE election deadline for New York State is October 15 2021. A major part of the budget legislation is a new.

The SALT Cap Workaround. New Yorks SALT Workaround. On March 8 2022 legislation House Bill 163 was signed into law that reduces New Mexicos gross receipts sales tax and compensating use tax rate to 5 percent effective on July 1 2022.

After several states enacted an entity-level tax as a state and local tax cap workaround New York legislators are contemplating following suit. 1 day agoThe new tax provision was adopted in 2021 by New York as a workaround to the federal income tax 10000 state and local tax SALT deduction limitation which disproportionately impacts. It allows individuals with income from pass-through entities such as LPs LLCs and S Corps to mitigate the loss of their SALT deduction on the income earned through these entities by having these entities opt to pay a federally deductible PTET which is then creditable against their New York personal.

New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget. Thus each partner has 1000000 of partnership income for New York tax.

A very significant federal income tax savings opportunity for many business owners is the optional New York State Pass-Through Entity Tax. Often Overlooked Tax Savings Opportunity. The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017 and without pointing fingers it seemed to many like it may have been taking a.

New Yorks pass-through entity tax PTET is one such SALT workaround. New York State issues guidance on SALT cap workaround - Mazars - United States. The Pass-Through Entity tax allows an eligible entity to pay New York State tax.

New York State Budget Agreement Includes A Pass-Through Entity Tax As A SALT Workaround 12 April 2021. Bed Bath Beyond renews Bohemia lease. The provision was part of Gov.

Pass-Through Entity Tax Update Part II.

The Pass Through Entity Workaround To Beat The Salt Limitation Certified Tax Coach

Salt Limitation And The New York State Pass Through Entity Tax Ptet By Adam E Panek Cpa Partner Grossman St Amour Cpas Pllc

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp

Don T Miss The Election For The Salt Cap Workaround

State And Local Taxes What Is The Salt Deduction Taxes Us News

State And Local Tax Deduction Bill Now Law In Illinois

Recapping Workarounds To The State And Local Tax Deduction Cap

Build Back Better Bill Latest On The Salt Deduction Battle

Dems Somehow Pretend This Mostly Helps The Middle Class The Daily Postercommentsharecommentshare

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

What Is The Salt Deduction H R Block

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

Mansion Tax Nyc Everything You Need To Know Yoreevo Yoreevo

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less